US Tariffs on AI Chips Signal Escalation in Tech Trade Tensions

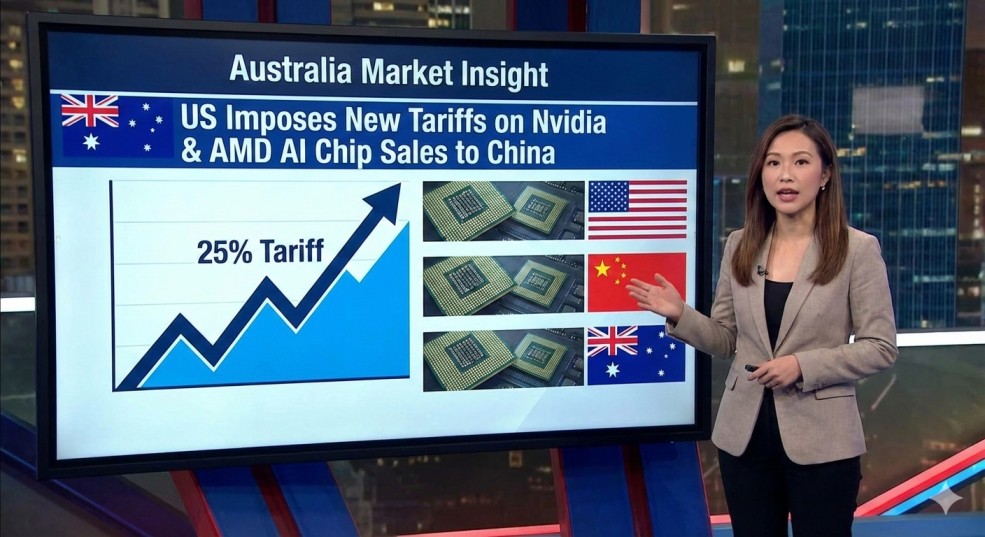

The United States has introduced a new tariff framework targeting advanced artificial intelligence (AI) chips sold by American semiconductor companies to China, marking another escalation in global technology trade tensions. Under the policy, US authorities will effectively claim 25% of the revenue generated from specific AI chip sales into China, impacting industry leaders such as Nvidia and AMD.

According to multiple media sources, the move is designed to monetise export permissions previously granted by the US government. Late last year, Washington allowed limited shipments of specific AI processors—such as Nvidia’s H200 and AMD’s MI-series chips—to China, reversing earlier export bans but attaching strict financial and compliance conditions.

How the Tariff Mechanism Works

The new levies apply to AI chips that are first imported into the United States and then re-exported to overseas buyers, including Chinese customers. By structuring the policy as a tariff rather than a direct payment requirement, the US administration aims to shield the arrangement from potential legal challenges while ensuring the government benefits financially from easing export controls.

Notably, chips used within the US for domestic AI infrastructure are exempt, reinforcing Washington’s objective of strengthening local semiconductor capacity while maintaining leverage over foreign supply chains.

Strategic Push to Onshore Semiconductor Manufacturing

The tariff announcement aligns with a broader US strategy to reduce reliance on overseas chip manufacturing. While companies like Nvidia and AMD design their processors domestically, production remains heavily dependent on Taiwan-based manufacturers, particularly TSMC.

In response to political pressure, Nvidia has committed hundreds of billions of dollars toward expanding manufacturing operations in the US over the coming years. Meanwhile, TSMC has begun producing advanced chips at its Arizona facility, though Taiwan remains the dominant global hub for cutting-edge semiconductors.

Implications for Australian Investors

For Australian markets, this development has several key implications:

- Increased volatility in global technology and semiconductor stocks

- Potential flow-on effects for ASX-listed miners, particularly those exposed to critical minerals used in chipmaking

- Ongoing geopolitical risk premiums affecting global supply chains

Australia’s role as a major supplier of critical resources positions it strategically as major economies seek to secure non-Chinese supply chains for advanced technologies.

Outlook

While US chipmakers have publicly supported the policy, citing balanced national and commercial interests, the risk of further tariffs—potentially extending to broader semiconductor products—remains. For investors, close monitoring of policy developments and supply chain shifts will be crucial for navigating the evolving tech landscape.

Disclaimer: Ace Investors Pty Ltd (ABN 70 637 702 188), authorised representative of MF & CO. ASSET MANAGEMENT PTY LTD (AFSL No.520442). Ace Investors has made every effort to ensure the reliability and accuracy of the views and recommendations expressed in the reports published on its websites. Ace Investors' research is based on the information known to us or which was obtained from various sources, which we believe to be reliable and accurate to the best of our knowledge. Ace Investors provides only general financial information on its website, in reports, and through newsletters, without considering the economic needs or investment objectives of any individual user. We strongly advocate that you seek advice from your financial planner, advisor, or stockbroker on the merits of each recommendation before acting on any recommendation for your specific financial circumstances, and that you realise not all investments will be suitable for all subscribers. To the scope permitted by law, Ace Investors Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Ace Investors Pty Ltd hereby limits its liability to the scope permitted by law to resupply the services. The securities and financial products we study and share information on, in our reports, may have a product disclosure statement or other offer document associated with them. You should obtain copies of these before making any decision to acquire any security or product. You can refer to our Financial Services Guide.