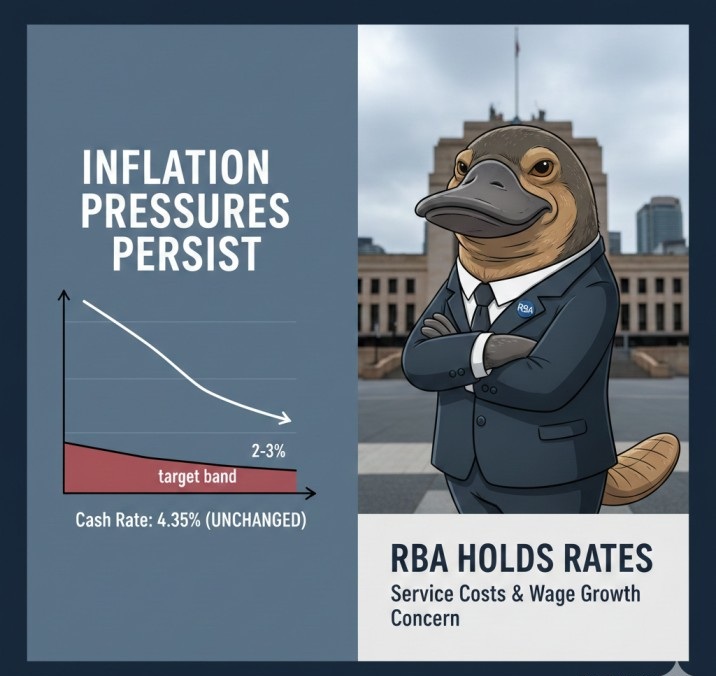

In a closely watched decision today, the Reserve Bank of Australia has kept the cash rate unchanged at 4.35 percent, marking the third consecutive hold in recent months. This comes as inflation figures show a gradual cooling but still hover above the bank's target band of 2 to 3 percent. Economists had mixed views going in, with some expecting a cut to support a slowing economy, while others pointed to sticky service costs and wage growth as reasons to stay put.

Governor Michele Bullock highlighted in her statement that while headline inflation eased to 3.6 percent in the September quarter, underlying measures remain elevated. The board emphasized a data-dependent approach, signaling potential easing if labor market softness deepens. Australia's unemployment rate ticked up to 4.1 percent last month, adding to concerns over consumer spending.

For investors, this stability offers a brief respite but underscores the need for vigilance. Sectors like retail and housing, already under strain from higher borrowing costs, could see prolonged headwinds. On the flip side, savers continue to benefit from competitive term deposit yields. Looking ahead, the January CPI release will be pivotal. With global uncertainties from U.S. elections and geopolitical tensions, the RBA's measured tone aims to anchor expectations without derailing recovery efforts.

ASX200 Dips as Tech Sell-Off Echoes Wall Street Wobbles

Australian shares took a hit today, with the ASX200 sliding 1.2 percent to close at 8,045 points, dragged down by a broader tech rout mirroring sharp declines on Nasdaq. The benchmark index's drop erased gains from the prior session, as investors grappled with renewed fears over U.S. tech valuations and slowing global semiconductor demand.

Key culprits included heavyweights like Wisetech Global and Xero, which shed 3.5 percent and 2.8 percent, respectively, amid reports of softening enterprise software spending. Miners offered some buffer, with BHP up 0.5 percent on steady iron ore prices, but energy stocks faltered as oil hovered near $75 a barrel. Broader market sentiment soured after U.S. data showed manufacturing contraction, raising doubts about a soft landing.

This volatility isn't isolated—Australia's tech sector, now 10 percent of the index, is increasingly tied to Silicon Valley's fortunes. For local players, it spotlights the risks of over-reliance on growth stocks. Diversification into defensive sectors such as healthcare and consumer goods could pay off if trade tensions escalate under a new U.S. administration.

Fortescue's Green Push Hits Milestone with New Hydrogen Plant

Fortescue Metals Group has notched a win in its pivot to green energy, officially opening a $50 million hydrogen production facility in Western Australia's Pilbara region. The plant, capable of generating 2,000 tonnes of green hydrogen annually, marks a key step in the miner's ambition to decarbonize its iron ore operations and tap into the burgeoning export market.

CEO Elizabeth Gaines called it a "game-changer" for sustainable mining, noting that the project is powered entirely by renewable solar and wind. It aligns with Australia's national hydrogen strategy, potentially unlocking billions in exports to Asia. Early partners include local utilities and international firms eyeing fuel cell tech.

Challenges remain: High upfront costs and infrastructure gaps could slow scaling. Yet, with carbon taxes looming and global steelmakers demanding greener inputs, Fortescue's bet positions it ahead of rivals like Rio Tinto. Shares rose 1.8 percent on the news, reflecting investor optimism.

NAB Lifts Home Loan Rates, Squeezing First-Time Buyers Further

National Australia Bank has nudged up its variable home loan rates by 0.15 percent, effective immediately, citing rising funding costs and the need to rebuild margins after a tough year. This move pushes the average variable rate to 6.45 percent, compounding pressures on households already stretched by elevated living expenses.

The hike affects around 200,000 customers and comes hot on the heels of similar adjustments by Westpac and ANZ. For first-home buyers, it's a stark reminder of the housing market's chill: Median prices in Sydney and Melbourne have flatlined, but affordability ratios remain near record lows. Refinancers might shop around, but with the RBA on hold, relief feels distant.

Economists warn this could further dampen consumption, as mortgage stress edges higher in outer suburbs. Banks defend the changes as prudent amid global rate uncertainty, but critics argue it's profit-driven at a vulnerable time.

Aussie Dollar Firm Amid Commodity Rally and China Stimulus Hopes

The Australian dollar strengthened 0.8 percent to US$0.672 today, buoyed by a rebound in commodity prices and optimism over fresh economic support measures from China, Australia's top trading partner. Iron ore futures climbed 2 percent, while copper gained on reports of Beijing's planned infrastructure spending boost.

This marks a reversal from last week's lows, as traders bet on stimulus to counter China's property slump. With exports to China making up 30 percent of Australia's total, any lift there flows through to the budget and mining giants. The RBA's steady stance also lent support, in contrast to a softening U.S. dollar following the Fed's comments.

Risks linger: Escalating U.S.-China trade frictions could quickly unwind gains. For currency traders and exporters, it's a welcome breather.

Disclaimer: Ace Investors Pty Ltd (ABN 70 637 702 188), authorized representative of MF & CO. ASSET MANAGEMENT PTY LTD (AFSL No.520442). Ace Investors has made every effort to ensure the reliability and accuracy of the views and recommendations expressed in the reports published on its websites. Ace Investors' research is based on the information known to us or which was obtained from various sources, which we believe to be reliable and accurate to the best of our knowledge. Ace Investors provides only general financial information on its website, in reports, and through newsletters, without considering the economic needs or investment objectives of any individual user. We strongly advocate that you seek advice from your financial planner, advisor, or stockbroker on the merits of each recommendation before acting on any recommendation for your specific financial circumstances, and that you realize not all investments will be suitable for all subscribers. To the scope permitted by law, Ace Investors Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Ace Investors Pty Ltd hereby limits its liability to the scope permitted by law to resupply the services. The securities and financial products we study and share information on, in our reports, may have a product disclosure statement or other offer document associated with them. You should obtain copies of these before making any decision to acquire any security or product. You can refer to our Financial Services Guide.