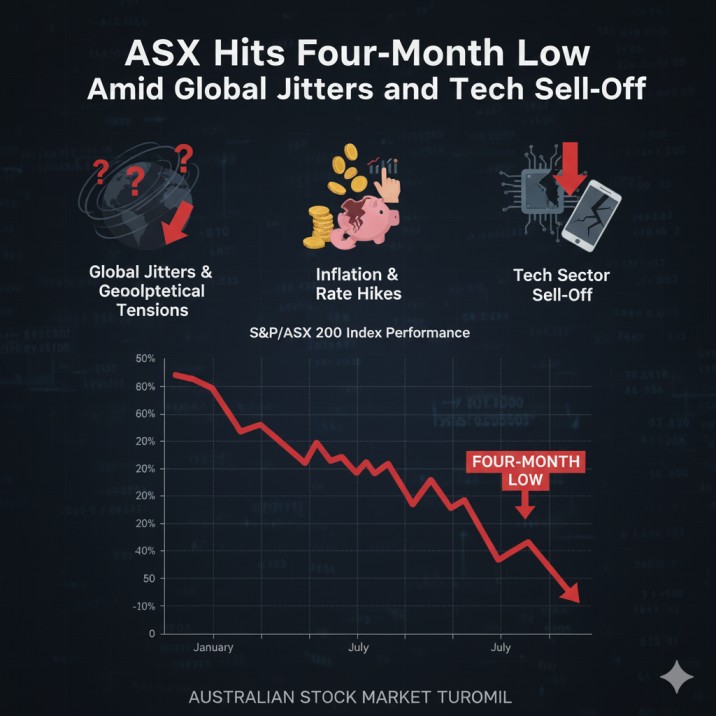

ASX Hits Four-Month Low Amid Global Jitters and Tech Sell-Off

The Australian sharemarket has taken a hit recently, with the S&P/ASX 200 dropping around 1.4% in a single session to its lowest point in months. This pullback comes from a mix of local company results disappointing investors and broader worries about interest rates staying higher for longer. Tech stocks led the decline, as seen with TechnologyOne shares plunging over 14% after their annual recurring revenue missed forecasts and they skipped giving guidance for the next year. Big banks like Commonwealth Bank also weighed on the index, continuing a rotation away from high-valued financial stocks.

This kind of volatility isn't unusual when global markets are nervous ahead of major US earnings reports, like Nvidia's upcoming numbers, and with economic data trickling back in after disruptions. Mining giants and energy plays have held up better in spots, but overall sentiment remains cautious. For Australian investors, it highlights how interconnected our market is with overseas trends, especially in tech and commodities.

What stands out is the speed of the shift – the ASX had been near record highs not long ago, but now it's shedding gains quickly. Rate cut hopes have faded a bit after stronger-than-expected jobs data locally, making borrowers and growth stocks feel the pinch. Still, history shows these dips can create buying opportunities in solid companies if the fundamentals hold.

At Ace Investors, we're keeping a close eye on resilient sectors like resources while advising caution on overextended tech names. Markets like this reward patience and research.

China's Looming Debt Shift Could Hammer Iron Ore and Australia's Economy

China is facing a major turning point with its massive debt load, and experts warn it will soon have to pivot from heavy investment to boosting consumer spending. That change, likely within the next few years, could send iron ore prices tumbling since Australia relies so heavily on exporting it to feed China's construction boom. Even with our sky-high property values acting as a buffer for household wealth, the hit to mining revenues and government budgets might leave us exposed.

This isn't just about one commodity – it's tied to broader trade ties. Beijing's stimulus efforts have propped things up so far, but sustaining that investment-led growth isn't viable long-term. Lower iron ore demand would ripple through to jobs in Western Australia, company profits for giants like BHP and Rio Tinto, and even the Aussie dollar.

For investors, this underscores the risks of over-reliance on China. Diversifying into other sectors or keeping an eye on global rebalancing could help mitigate the fallout. Australia's terms of trade have been a boon for years, but shifts like this remind us nothing lasts forever.

At Ace Investors, we factor in these macro risks when picking stocks, favoring companies with strong balance sheets that can weather commodity swings.

First Home Buyers Drive Surge in Entry-Level Property Prices

The federal government's expanded 5% deposit scheme has sparked a noticeable jump in house prices at the more affordable end of the market. Suburbs popular with first-time buyers are seeing faster growth as lower deposit requirements make it easier for younger people to enter the property ladder, boosting demand in those areas.

This policy aims to help more Aussies own homes without waiting years to save a big deposit, but it's also contributing to price pressure where supply is tight. While overall market growth has moderated, the bottom tier is heating up, which could widen the gap for those still locked out.

It's a double-edged sword: great for getting on the ladder sooner, but it risks inflating bubbles in starter suburbs. Banks and economists are watching closely to see if this feeds into broader inflation or just redistributes activity.

For property investors or those eyeing the market, focus on areas with strong fundamentals like jobs growth and infrastructure.

Major Super Funds Exposed to Massive US Solar Energy Bankruptcy

Several big Australian superannuation players, including AustralianSuper and HESTA, have significant money tied up in a US renewable energy firm that's now bankrupt with debts over $9 billion. Pine Gate Renewables' collapse highlights the risks in chasing high-growth green investments overseas, especially in volatile sectors like solar.

This comes at a time when super balances are crucial for retirement security, and losses here could dent returns for millions of members. Funds are assessing the damage, but it serves as a reminder that even diversified portfolios can face surprises in private markets or international bets.

Renewables remain a long-term theme, but execution and debt levels matter hugely. Australian funds have been aggressive in alternatives for yield, but this fallout might prompt more caution.

Future Fund Turns to Gold and Active Strategies in Uncertain Times

Australia's sovereign wealth fund is adjusting its approach for a world of ongoing crises, boosting holdings in gold and favoring active management over passive indexes. With geopolitical tensions rising, they see traditional portfolios struggling to deliver long-term targets.

Gold acts as a hedge against inflation and instability, while active picks aim to navigate volatility better. This shift reflects broader concerns that low-risk bonds and stocks might not cut it anymore in a "permacrisis" era.

For everyday investors, it’s a signal to consider diversifiers like precious metals or funds that actively seek value.

Disclaimer: Ace Investors Pty Ltd (ABN 70 637 702 188), authorized representative of MF & CO. ASSET MANAGEMENT PTY LTD (AFSL No.520442). Ace Investors has made every effort to ensure the reliability and accuracy of the views and recommendations expressed in the reports published on its websites. Ace Investors' research is based on the information known to us or which was obtained from various sources, which we believe to be reliable and accurate to the best of our knowledge. Ace Investors provides only general financial information on its website, in reports, and through newsletters, without considering the financial needs or investment objectives of any individual user. We strongly advocate that you seek advice from your financial planner, advisor, or stockbroker on the merits of each recommendation before acting on any recommendation for your specific financial circumstances, and that you realize not all investments will be suitable for all subscribers. To the scope permitted by law, Ace Investors Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Ace Investors Pty Ltd hereby limits its liability to the scope permitted by law to resupply the services. The securities and financial products we study and share information on, in our reports, may have a product disclosure statement or other offer document associated with them. You should obtain copies of these before making any decision to acquire any security or product. You can refer to our Financial Services Guide.