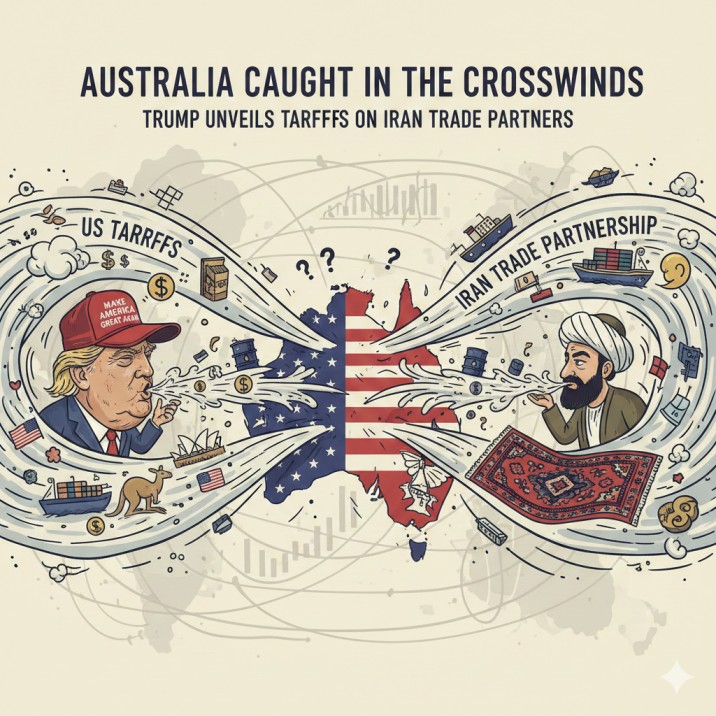

The global trade landscape has taken another sharp turn after US President Donald Trump announced sweeping tariffs on countries that continue to do business with Iran. Under the proposal, any nation engaged in trade with Tehran would face a 25% tariff on exports to the United States, effective immediately, according to Trump's social media statements.

According to some international media reports, the move could have broad implications for global supply chains, particularly across the Asia-Pacific region. More than 100 countries reportedly maintained some level of trade with Iran in the first half of 2025, despite longstanding US sanctions. Major economies such as China, India, Turkey, and Pakistan are among Iran’s key trading partners, placing them directly in the firing line of Washington’s latest trade escalation.

For Australia, the announcement raises essential considerations. While Australia's direct trade exposure to Iran is limited due to existing sanctions, the secondary effects could be significant. Any disruption to Asian trade flows — particularly involving China and India — may impact Australian exporters, commodity prices, shipping costs, and broader market sentiment.

The tariff announcement comes amid escalating geopolitical tensions. Iran has been facing widespread civil unrest, with reports of mass detentions and rising casualties following nationwide protests. Although independent verification has been difficult due to internet restrictions inside Iran, the unrest has prompted increasingly forceful rhetoric from the US administration.

Trump has indicated that military options are being reviewed alongside economic measures, signalling a more aggressive stance toward Tehran. According to US officials, non-military tools — including financial and trade pressure — are also being considered as part of a broader strategy to weaken Iran’s leadership.

For investors, this development adds another layer of uncertainty at a time when global markets are already navigating slowing growth, volatile energy prices, and ongoing trade realignments. Energy markets, shipping stocks, defence contractors, and emerging market assets could all experience heightened volatility as markets digest the potential fallout.

Australian investors should closely monitor how key trading partners respond and whether retaliatory measures emerge. Any prolonged escalation could influence commodity demand, currency movements, and regional equity market performance.

As geopolitical risks rise, staying informed and agile remains essential. Market conditions can shift rapidly when trade policy and global security intersect — and this latest announcement is a clear reminder that political risk is once again front and centre for international investors.

Disclaimer: Ace Investors Pty Ltd (ABN 70 637 702 188), authorised representative of MF & CO. ASSET MANAGEMENT PTY LTD (AFSL No.520442). Ace Investors has made every effort to ensure the reliability and accuracy of the views and recommendations expressed in the reports published on its websites. Ace Investors' research is based on the information known to us or which was obtained from various sources, which we believe to be reliable and accurate to the best of our knowledge. Ace Investors provides only general financial information on its website, in reports, and through newsletters, without considering the economic needs or investment objectives of any individual user. We strongly advocate that you seek advice from your financial planner, advisor, or stockbroker on the merits of each recommendation before acting on any recommendation for your specific financial circumstances, and that you realise not all investments will be suitable for all subscribers. To the scope permitted by law, Ace Investors Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Ace Investors Pty Ltd hereby limits its liability to the scope permitted by law to resupply the services. The securities and financial products we study and share information on, in our reports, may have a product disclosure statement or other offer document associated with them. You should obtain copies of these before making any decision to acquire any security or product. You can refer to our Financial Services Guide.