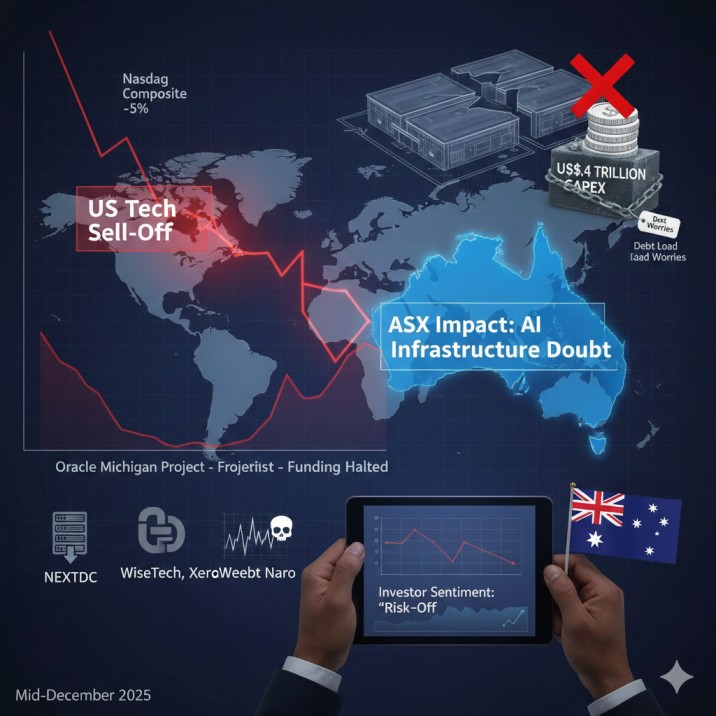

US technology stocks took a hit this week after reports emerged that a major financier had backed out of a large Oracle data centre project. This news highlighted growing investor worries about the heavy debt loads companies are taking on to build AI-related facilities.

The Nasdaq Composite index fell around 1.8 per cent in recent trading, marking its lowest close in weeks. Oracle shares dropped more than 5 per cent after Blue Owl Capital said it would not fund a planned US$10 billion data centre in Michigan. Oracle has disputed some aspects of the reporting, stating that negotiations for the project are progressing with other partners.

This pullback builds on earlier concerns from disappointing results by Oracle and other chip firms, which failed to meet high expectations for AI-driven growth. Prominent names like Nvidia, Alphabet, and Broadcom also declined, reflecting broader unease about whether the massive investments in AI hardware will deliver quick returns.

On a positive note, memory chip maker Micron provided an upbeat forecast after the US market close, projecting strong revenue growth driven by the tight supply of advanced chips for AI applications. Its shares rose in after-hours trading.

The sell-off prompted some rotation into safer sectors, with energy stocks gaining amid rising oil prices.

In Asia, markets opened lower on Thursday, with Japan's Topix down about 0.4 per cent, South Korea's Kospi falling 1.2 per cent, and China's CSI 300 slipping 0.3 per cent. Australian investors should watch for similar pressure on local tech names when the ASX opens, as global sentiment often flows through to our market.

While short-term volatility is likely, the long-term demand for AI infrastructure remains intact, according to many analysts. This could present buying opportunities in quality stocks during dips.

Disclaimer: Ace Investors Pty Ltd (ABN 70 637 702 188), authorised representative of MF & CO. ASSET MANAGEMENT PTY LTD (AFSL No.520442). Ace Investors has made every effort to ensure the reliability and accuracy of the views and recommendations expressed in the reports published on its websites. Ace Investors' research is based on the information known to us or which was obtained from various sources, which we believe to be reliable and accurate to the best of our knowledge. Ace Investors provides only general financial information on its website, in reports, and through newsletters, without considering the economic needs or investment objectives of any individual user. We strongly advocate that you seek advice from your financial planner, advisor, or stockbroker on the merits of each recommendation before acting on any recommendation for your specific financial circumstances, and that you realise not all investments will be suitable for all subscribers. To the scope permitted by law, Ace Investors Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Ace Investors Pty Ltd hereby limits its liability to the scope permitted by law to resupply the services. The securities and financial products we study and share information on, in our reports, may have a product disclosure statement or other offer document associated with them. You should obtain copies of these before making any decision to acquire any security or product. You can refer to our Financial Services Guide.