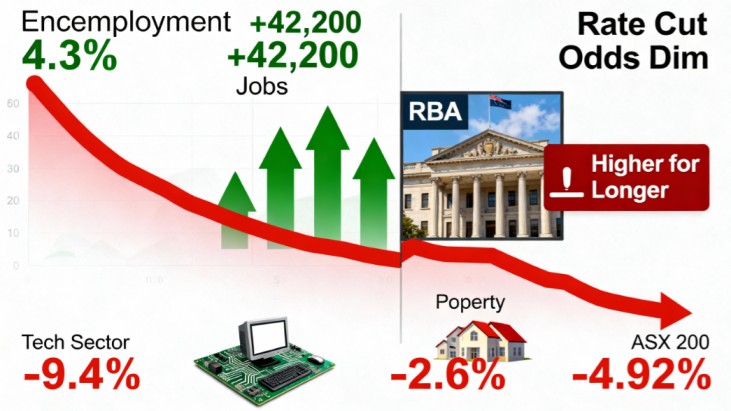

Australia's stock market felt the sting of unexpectedly strong employment figures today, pushing the S&P/ASX 200 down 0.5% to close at 8,753.4. What started as a sharper 1% drop early in the session reflected investor jitters over the Reserve Bank of Australia's next moves. October's unemployment rate dipped to 4.3% from 4.5%, with 42,200 new jobs added—well above forecasts. This resilience has slashed the chances of a June rate cut to just 30%, down from 80% last week, as traders worry about reigniting inflation.

Financials bore much of the brunt. ANZ shed nearly 5% to $36.94 on ex-dividend trading, while Westpac and NAB each lost over 1%. Tech names, sensitive to borrowing costs, took a beating too: Xero plunged 9% to $127.36 after expenses came in higher than anticipated, NextDC fell 4% to $14.53, and WiseTech dropped 2.1% to $68.01. Property developers like Mirvac, Stockland, and Charter Hall each declined around 3%, amplifying the sector's woes.

Energy stocks followed suit, dragged by a 4% oil price slump after OPEC noted ample global supply. Woodside eased 2.8% to $26.16, and Santos slipped 2.2% to $6.54. On a brighter note, materials held firm thanks to gold hovering near $US4,200/oz. Newmont climbed 3.8% to $143, Evolution Mining gained 3% to $11.85, and Regis Resources jumped 5.1% to $7.23 after extending its Duketon North mine life.

Standout movers included DroneShield, which cratered 31.4% to $2.25 after insiders, including CEO Oleg Vornik, sold $70 million in shares. GrainCorp tumbled 10.8% to $7.98 on a 35% profit drop to $40 million. Positively, Orica rose 2.5% to $23.40 with a 32% profit surge to $541 million—its best in over a decade. Sandfire Resources nudged up 1.4% on a deal for up to 80% of Havilah's Kalkaroo project, sending Havilah soaring 48% to 40¢. Webjet warned of earnings between $30-32 million, down 14%, causing a 17.2% slide to 72¢. Guzman y Gomez dipped 1.8% to $23.95 but stuck to its FY26 guidance.

eToro's Farhan Badami noted the labor market's strength leaves little room for RBA easing without inflation risks. As global cues mixed—with Wall Street's Dow resetting highs but Nasdaq slipping—the ASX faces a cautious path ahead. Investors should watch upcoming earnings for clues on corporate health amid this policy pivot.

MinRes Surges on $1.2B Lithium Deal: ASX Dips as Tech Weighs In

The ASX edged lower for a second straight day, with the S&P/ASX 200 off 0.2% at 8,799.5, as banking and tech drags offset a commodities rebound. Hopes for Chinese stimulus lifted iron ore above $US102.5/t, fueling gains in miners, but Life360's growth miss and CBA's soft results kept pressure on.

Materials stole the show. BHP ticked up 0.6% to $43.06, Rio Tinto climbed 2.3% to $132.47, and South32 rose 1.6% to $3.24. Lithium shone brightest: Mineral Resources rocketed 9.2% to $51.23—a yearly high—after offloading a big chunk of its lithium ops to POSCO for $1.2 billion. This cash infusion bolsters MinRes' balance sheet, per analysts. Liontown gained 6.1% to $1.315 on a new spodumene sales partnership.

Gold miners rode rate cut bets, with Evolution up 2% to $11.50 and Newmont +0.9% to $137.73. Copper and oil also perked up, lifting Great Southern Copper 7.4% and Woodside 1.4% to $26.92.

Tech faltered 3.3%. Life360 cratered 13.1% to $39.81 on sluggish user adds. Xero slipped 2.2% to $140, WiseTech -0.8% to $69.49. CBA plunged 3.1% to $158.38—a seven-month low—after earnings underwhelmed on margins.

Elsewhere, Megaport dipped 1.6% to $15.05 post a $200M raise for acquisitions. Aristocrat Leisure fell 7.5% to $59.42 on interactive segment woes. Flight Centre edged up 1% to $12.23, hiking its FY26 profit outlook.

China's October exports tanked—the worst since February—amid US tariffs, but looser policy signals sparked commodity optimism. Global markets soured: NZX -1%, Hang Seng -1.85%, Nikkei -1.77%, as US shutdown fears lingered.

This tug-of-war underscores diversification's value. With stimulus whispers from Beijing, commodities could lead a recovery, but watch tech earnings for volatility.

Beating the US Tech Hype: How One Fund Manager's Global Play Pays Off

In a world obsessed with Nvidia and the "Magnificent Seven," Armina Rosenberg's approach at Minotaur Capital stands out. The co-founder is trouncing benchmarks by dialing back on US giants and hunting value elsewhere. While the MSCI All Country World Index is 70% US-heavy, her fund caps exposure at half that, freeing up capital for overlooked gems.

This contrarian bet has Rosenberg outperforming amid tech's dominance. She's naming picks like an under-the-radar pharma play and a budget airline as standouts. By avoiding the hype cycle, Minotaur sidesteps volatility from AI bubbles and tariff threats.

Rosenberg's strategy echoes timeless investing: Diversify beyond the crowd. With US valuations stretched, her global tilt—focusing on Europe, Asia, and Aussie industrials—captures steady growth in sectors like healthcare and travel. Early career wins taught her to ignore noise; now, it's delivering alpha.

For Aussie investors, this is a reminder: Local markets offer resilience. Pair Minotaur's playbook with ASX blue-chips for balanced returns. As markets evolve, staying nimble beats chasing trends.

Investors Brush Off Rate Hike Fears Despite Stellar Jobs Surge

Even with unemployment hitting a solid 4.3% in October—down from 4.5%—bond markets aren't buying into RBA hike chatter. The robust report, adding thousands of jobs, sparked a brief ASX dip over 1%, hitting property devs hardest. But traders see no room for tightening; instead, they're pricing in stability.

This pushback stems from inflation's fade and global softness. Bond yields held steady, signaling cuts later in 2026. Property's slide underscores rate sensitivity, but broader sentiment favors easing over hikes.

For investors, it's a green light to hold steady. Strong labor supports spending without overheating—ideal for equities. Watch RBA rhetoric for confirmation.

Lithium Revival: Battery Boom Lifts ASX Miners to New Heights

ASX lithium plays are charging ahead, with spodumene prices doubling in five months to $US1,011/t—the highest since mid-2024. Battery storage and EV demand are the catalysts, per investment banks revising forecasts upward.

Pilbara Minerals and Mineral Resources lead the pack, riding this wave as supply tightens. This sector shift promises sustained gains, countering earlier slumps.

For portfolios, it's a buy signal on green energy. Balance with diversified holdings to ride the volatility.

Disclaimer: Ace Investors Pty Ltd (ABN 70 637 702 188), authorized representative of MF & CO. ASSET MANAGEMENT PTY LTD (AFSL No.520442). Ace Investors has made every effort to ensure the reliability and accuracy of the views and recommendations expressed in the reports published on its websites. Ace Investors' research is based on the information known to us or which was obtained from various sources, which we believe to be reliable and accurate to the best of our knowledge. Ace Investors provides only general financial information on its website, in reports, and through newsletters, without considering the financial needs or investment objectives of any individual user. We strongly advocate that you seek advice from your financial planner, advisor, or stockbroker on the merits of each recommendation before acting on any recommendation for your specific financial circumstances, and that you realize not all investments will be suitable for all subscribers. To the scope permitted by law, Ace Investors Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Ace Investors Pty Ltd hereby limits its liability to the scope permitted by law to resupply the services. The securities and financial products we study and share information on, in our reports, may have a product disclosure statement or other offer document associated with them. You should obtain copies of these before making any decision to acquire any security or product. You can refer to our Financial Services Guide.