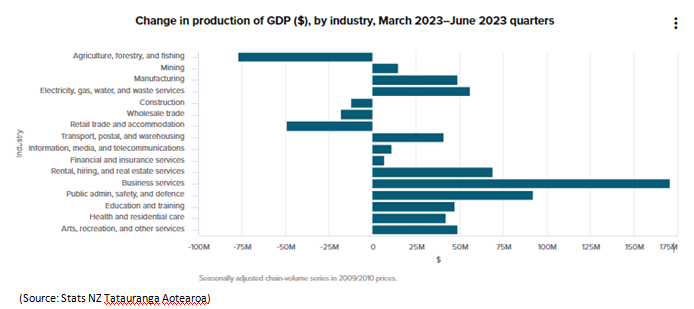

New Zealand is a highly developed free-market economy. It is the 52nd national economy in the world measured by nominal gross domestic product (GDP) and the 62nd in the world measured by purchasing power parity (PPP). For the year ended on 30 June 2023 (June 23Q), New Zealand recorded 3.2% YoY growth in GDP, specifically driven by strong growth in New Zealand's Service Sector with the top three contributors to the growth were ‘Transport, postal, and warehousing’, Arts, and recreation, and Health care and social assistance. For FY23, New Zealand’s Service sector contributed to 4.3% growth in GDP. For the quarter ended on 30 June 2023(June23Q), New Zealand recorded a 0.9%QoQ growth in GDP compared with the quarter ended on 31 Mar2023 (Mar23Q), driven by a 1% increase in the Service sector with top three contributors to the growth were Business services, Public administration, Rental, hiring, and real estate services. For June23Q, Business services recorded 2.1% QoQ growth, driven by computer system design and related services and employment and other administrative services while Public administration, safety, and defense for the period recorded 2.8%QoQ growth driven by public order, safety, and regulatory services. Rental, hiring, and real estate services for the period were up 0.7%, driven by real estate services. Key downward drivers to the change in production for the period were Agriculture, forestry, and fishing and retail trade, accommodation, and restaurants. For June23Q, ‘Agriculture, forestry, and fishing’ was down 2.3% while ‘Retail trade, accommodation, and restaurants’ were down 1.0%. (Source: Stats NZ Tatauranga Aotearoa)

For the year ended on 30 June 2023(June23Q), New Zealand recorded 2.2% YoY growth in real gross national disposable income and 1.2% YoY growth in real gross national disposable income per capita. While GDP measures economic activity, real gross national disposable income (RGNDI) measures the volume of goods and services that New Zealand residents have command over i.e., the real purchasing power of the country’s disposable income. New Zealand’s ability to buy goods and services from its income, RGNDI, increased 0.8% in June 23Q. Over the June 2023 quarter, export prices fell 0.6 percent, while import prices fell 1.0 %, increasing the terms of trade in the quarter. An increase in the terms of trade results in fewer exports being required to pay for a given volume of imports i.e. residents can purchase more goods and services by volume from the income generated from a given level of domestic production. The 0.8 % rise in RGNDI, coupled with a population increase of 0.6 % over the quarter, increased RGNDI per capita by 0.1 % in the quarter. Annually, RGNDI grew 2.2 % over the year to June 2023 while RGNDI per capita rose 1.2% over the year.

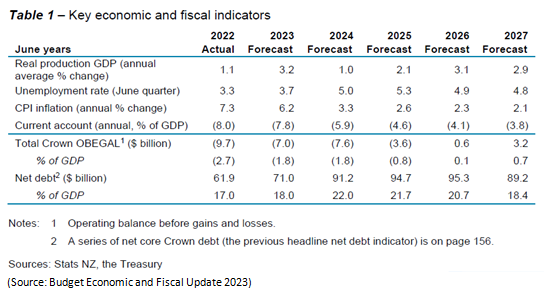

The New Zealand economy is experiencing higher inflation after a prolonged period of excess demand. CPI inflation peaked For the 12 months to the Sep’2023 quarter (Sep23Q), New Zealand recorded a CPI inflation rate of 5.6%, specifically driven by increases in the price levels of food items, housing and household utilities, and transport. The unemployment rate also declined to a record low in the June'2022 quarter and is expected to further increase to 5.0% in 2024. As a result, the Reserve Bank of New Zealand (Reserve Bank) increased the official cash rate (OCR) to dampen demand. The Treasury forecasts economic growth in New Zealand to remain low over 2023, leading to an increase in the unemployment rate into 2024. In its ‘Budget Economic and Fiscal Update 2023’, New Zealand’s Treasury department forecasts a Real GDP growth rate of 3.2% in 2023, declining to a Real GDP growth rate of 1.0% in 2024 and increasing to 2.1% in 2025. However, the rebuild following the North Island weather events, a quicker return of tourism, and less-contractionary fiscal policy are going to offer more support to the economy than anticipated at its Half Year Update. Consequently, the Treasury anticipates an economic slowdown over 2023 less than what was forecasted in Dec’2022. Before the COVID-19 pandemic, tourism generated a direct annual contribution to GDP of $16.4 billion, or 5.5% of GDP, and a further indirect contribution of $11.3 billion, or 3.8% of GDP. In 2022, tourism generated a direct contribution to GDP of $10.0 billion, or 3.0% of GDP. According to the Ministry of Business, Innovation and Employment (MBIE), International visitor arrivals to New Zealand are forecast to reach 5.1 million visitors in 2024 (from 3.7 million in 2017, up 37.1 percent). As per the credit rating agency Fitch, the resurgence in tourism to significantly support New Zealand's real GDP growth in 2024. Fitch forecasts total arrivals of 3.89mn in 2024, marking a 55.3% y-o-y increase and on par with the 3.9 million recorded in 2019. (Source: Stats NZ Tatauranga Aotearoa; Budget Economic and Fiscal Update 2023, Fitch Solutions)

Disclaimer: Ace Investors Pty Ltd (ABN 70 637 702 188) authorized representative of Alpha Securities Pty Ltd (AFSL No.330757). Ace Investors has made all efforts to warrant the reliability and accuracy of the views and recommendations articulated in the reports published on its websites. Ace Investors research is based on the information known to us or which was obtained from various sources which we believed to be reliable and accurate to the best of its knowledge. Ace Investors provides only general financial information through its website, reports and newsletters without considering financial needs or investment objectives of any individual user. We strongly advocate that you seek advice, with your financial planner, advisor or stock broker, the merit of each recommendation before acting on any recommendation for their own specific financial circumstances and realize that not all investments will be suitable for all subscribers. To the scope permitted by law, Ace Investors Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Ace Investors Pty Ltd hereby limits its liability, to the scope permitted by law to resupply of the services. The securities and financial products we study and share information on, in our reports, may have a product disclosure statement or other offer document associated with them. You should obtain a copy of these before making any decision about acquiring any security or product. You can refer to our Financial Services Guide.